Over the past decade, a wave of innovation has swept through all corners of the payments landscape. As a result, the needs of market participants have evolved and they continue to do so at a substantial pace.

Here are our predictions for the key trends to watch as 2024 unfurls.

1. Account-to-Account payments soar

Account-to-account (A2A) payments bypass intermediaries such as credit card and payment processors, enabling money to be transferred directly from one party’s account to another account instantly. That makes them faster, more convenient and less costly than

traditional bank transfers.

Although A2A payments are not new, API technology and the move to open banking have provided the payment rails for A2A payments to take off. We expect rapid growth to continue in step with further adoption worldwide of instant digital payment solutions for

retail and corporate use.

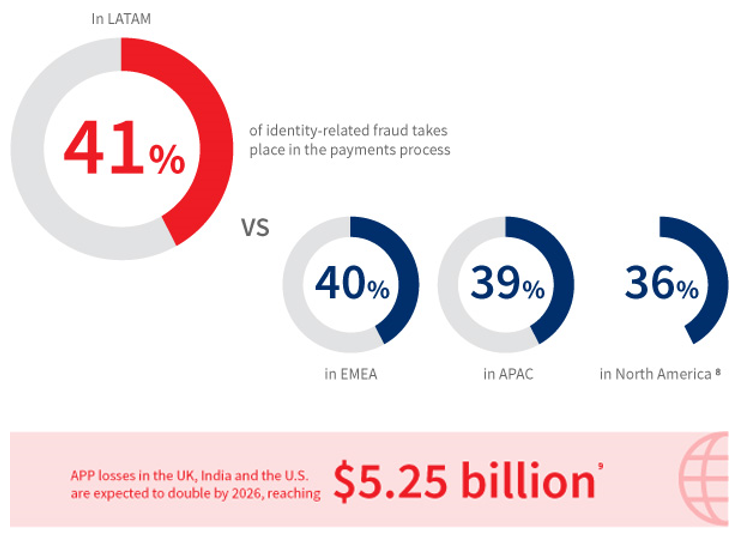

2. Payment fraud explodes

With payments moving online and real-time payment systems becoming the norm, authorised push payment (APP) fraud is more prevalent than ever. In fact,

it is the number one fraud threat globally, surpassing card fraud and identity theft.

APP fraud is perpetrated when fraudsters use social engineering techniques such as impersonation scams to trick unwary consumers into sending a payment to them. Combatting APP fraud remains a challenge because it happens in real time and cannot be reversed.

We expect wider adoption of confirmation of payee (CoP) and similar controls to temper APP fraud going forward.

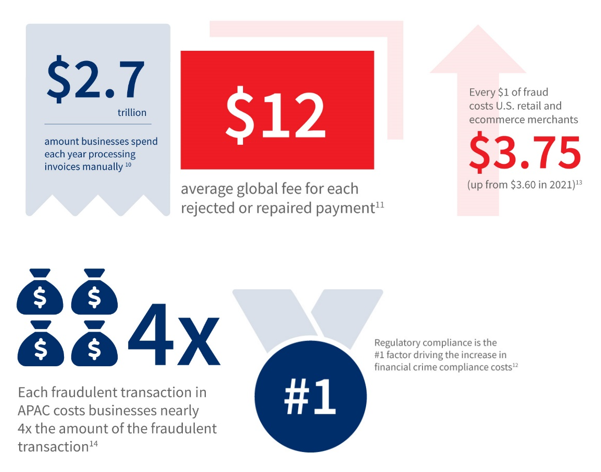

3. Reducing the cost of payments becomes imperative

A confluence of factors from high interest rates to volatile credit markets are driving up the cost of payments and making liquidity management ever more challenging. Compliance controls, which are especially high for international payments, further increase

costs. Automating payments processes to speed processing, reduce failed payments and prevent fraud will remain a top focus for businesses looking to reduce costs in 2024.

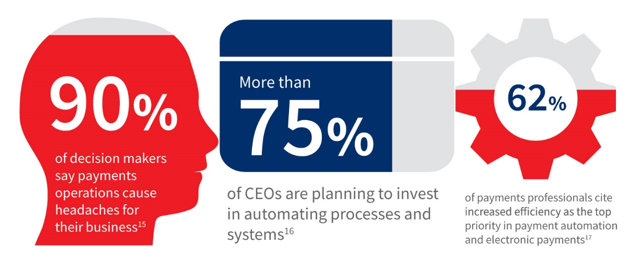

4. Corporates drive for efficiency

Corporates are increasingly bringing payments operations in-house to gain greater control and deliver a better customer experience. This has fuelled the growth of corporate treasury management systems that are able to manage liquidity and deliver

efficiency gains by offering a centralised hub for all payments activity, including payment routing. With the faster processing and real-time visibility these systems offer, we expect the number of companies who manage their own payment operations to increase

significantly.

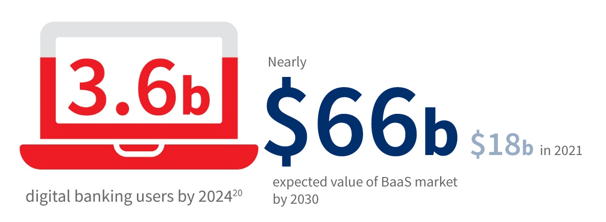

5. Banking-as-a-Service (BaaS) gains momentum

Banks are transforming their payment service operations and diversifying revenue by offering real-time payments capabilities to corporate and other customers through APIs.

This BaaS approach enables banks to become a channel partner and resell payment routing solutions to end customers, providing companies with a holistic solution to manage the growing complexity of payments routing. With a

CAGR of more than 15% BaaS is expected to gain even wider adoption over the next few years.

What’s next?

Companies that consider payments processes in relation to the overall customer experience will find themselves ahead of the competition and ahead of the curve.